Cash Kingdom App Review: Hello, dear readers! If you’ve stumbled upon this article, you’re likely curious about the Cash Kingdom Loan App. You’re in the right spot! Today, we’re going deep into this app to share insights, warnings, and answers to important questions. The Cash Kingdom App Reviews is dedicated to shedding light on this app, helping you make informed decisions and safeguarding your financial interests.

Table of Contents

Understanding Cash Kingdom App

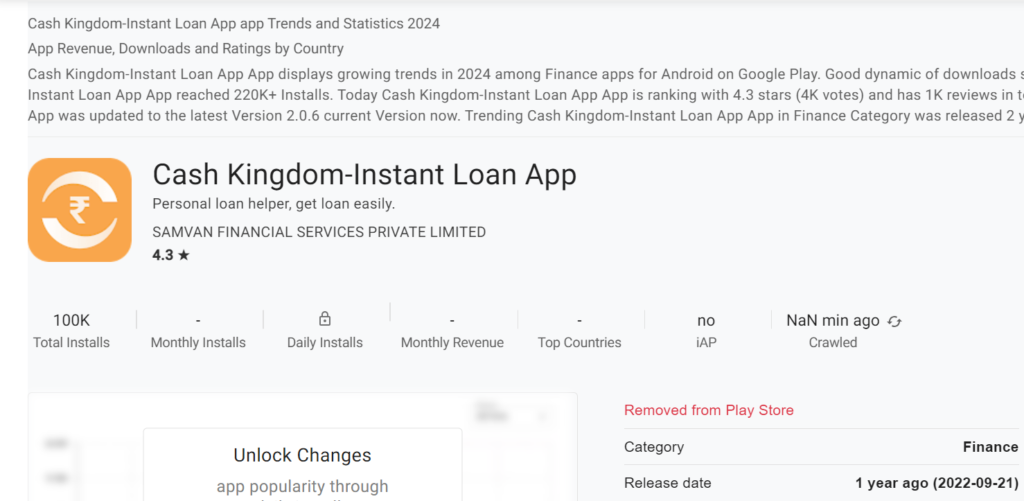

Cash Kingdom isn’t your typical loan provider; it acts as a platform facilitating transactions between users and registered non-bank financial companies (NBFCs) or banks. Interestingly, they’ve been tight-lipped about their NBFC partners, revealing only their association with SAMVAN FINANCIAL SERVICES PRIVATE LIMITED.

Their vision, as stated, is to offer customers a selection of safe loan products through an online marketplace. Now, let’s delve into the specifics of the matter.

Cash Kingdom App Specifications

App Name: Cash Kingdom

Product Description:

- High Loan Amount: Up to Rs. 50,000.

- Fast Loan Approval: Streamlined online application, rapid approval, and swift disbursement.

- Secure Loan: Personal information encryption ensures data safety throughout the process.

Loan Details:

- Minimum loan: Rs. 5000

- Maximum loan: Rs. 50,000

- Loan term: 91 days to 120 days

- Maximum annual interest rate: 18.25%

- Transparent fees with no hidden costs

Contact Information:

- Email: cashkingdom@rediffmail.com

- Address: Chechaul, Patna, NH-97, Bikram Road, Patna, Bihar 801109, India

Cash Kingdom Customer Care Number: Not Available

Cash Kingdom App Review User Complaints: A Red Flag?

The internet is buzzing with Cash Kingdom complaints, with users sharing their unfortunate experiences on consumer complaints websites. Such feedback raises concerns and prompts a closer examination of the app’s operations.

Cash Kingdom Loan Interest Calculation

Understanding the nitty-gritty of loan interest is crucial. For example, let’s take a loan of Rs. 20,000 with a tenure of 120 days. The daily interest rate is calculated at 18.25%/365, resulting in Rs. 10 per day. Monthly interest amounts to Rs. 300, making the total monthly payment Rs. 5,300. The total interest fee after 120 days is Rs. 1200, bringing the final repayment amount to Rs. 21,200.

Cash Kingdom App Application Conditions

To access Cash Kingdom’s loan services, users must meet specific criteria:

- Indian resident

- Age above 21 years

- Monthly source of income

Meeting these requirements enables users to apply for a loan through the app.

Security and Privacy: Can You Trust Cash Kingdom?

Cash Kingdom promises that your personal info is safe and won’t be shared without your permission.. However, scrutinizing their data safety practices reveals the following:

- No Data Shared with Third Parties: The app claims not to share user data with other companies.

- Data Collected: Various data points, including location, personal information, financial details, messages, photos & videos, files & docs, contacts app, device or other IDs, app activity, and app info and performance.

Steps to Avail Cash Kingdom: A Quick Guide

If you’re considering using Cash Kingdom, here’s a brief overview of the process:

- Install the Cash Kingdom App

- Sign up with your mobile number

- Fill in basic information and check your eligibility

- Upload KYC documents, including ID, address proof, and PAN card.

- Request a bank transfer or an E-voucher for your loan

Red Flags: What Sets Cash Kingdom Apart

- Hidden Owner Information: The app conceals details about its owner, creating uncertainty and raising suspicions.

- Not Registered with Government Authority: Lack of registration with relevant authorities is a significant red flag, questioning the app’s authenticity.

- No Social Media Presence: The absence of Cash Kingdom on social media raises questions about transparency and willingness to engage with users openly.

- Loan Trap Modus Operandi: Users report being trapped into loans with exorbitant interest and processing fees, leading to financial distress.

- Scary Privacy Policy: The app’s privacy policy, allowing access to extensive personal and financial data, raises concerns about potential misuse and privacy violations.

Signs to Detect Personal Loan App Scams

Detecting potential scams is crucial to safeguard your financial well-being. Here are some signs to watch out for:

- Not Interested in Payment History: Genuine lenders consider payment history, while scammers target high-risk borrowers for their own gain.

- No Physical Address: Scam apps often provide fake addresses, hiding their true identity and making it challenging to trace them.

- Not a Registered Company: Legitimate financial apps should be registered with the relevant authorities, providing transparency and accountability.

- Lack of Security Measures: Scam apps may lack robust security measures, leaving users vulnerable to data breaches and fraud.

- Pressurize to Act Immediately: Scammers create a sense of urgency, pressuring users to act quickly without thoroughly evaluating the legitimacy of the app.

Conclusion: Cash Kingdom App Reviews

In conclusion, the Cash Kingdom App is not recommended due to multiple red flags and negative user experiences. Personal loans are often sought in times of financial crunch, and falling prey to unscrupulous apps can exacerbate the situation.

In crafting this blog on scam awareness, I drew valuable insights from Wisdom Ganga, a team dedicated to exposing scams and keeping the online community informed. Check out their website for more crucial information on staying vigilant against scams.

This review aims to caution users against fraudulent apps and encourages the use of reputable channels. Always conduct thorough checks, avoid hasty decisions, and prioritize your financial safety.

If you Like Cash Kingdom App Reviews article and believe it can benefit others, kindly share it. If you’re not sure about a website or app, or feel anything suspicious, let us know in the comments or message us on Facebook, Twitter, or Instagram.

Also Read: Turat Fund Loan App Review

We’re here for you! We value your vigilance and appreciate your proactive engagement. Your input is valuable to us! Your awareness and engagement make a difference.

Remember, financial well-being is paramount. Choose wisely, stay informed, and protect yourself from unscrupulous practices.

1 Comment

[…] Also Read: Cash Kingdom App Review […]