Dutta Rupee Loan App Review: Welcome to DailyRadar! Today, we delve into the world of Dutta Rupee, a loan application claiming to provide quick financial solutions. Yet, when we examine it more closely, a concerning story unfolds, prompting doubts about its legitimacy. In this comprehensive review, we will dissect the Dutta Rupee Loan App Review, examining its positives, negatives, and and what users are saying to help you make a smart decision.

Table of Contents

Dutta Rupee Loan App Details

Dutta Rupee, a free loan app in India developed by Aliran Eduardo 1999, promises convenience and accessibility through a paperless loan application method. But does it do what it says? Let’s explore.

Download Link: https://dutta-rupee.en.softonic.com/android

You can borrow different amounts, starting from ₹2,000 up to ₹60,000, and the processing fees range between ₹90 and ₹2,000. Borrowers, aged 18 to 65 with a steady income, can choose repayment terms from 91 days to 12 months. The interest rates vary from 12% to 32%, posing both an advantage and a concern.

How It Works

Dutta Rupee facilitates speedy loans for those facing immediate financial needs. The application process is simple, requiring no collateral, and boasts a quick approval system. However, complaints about unfavorable repayment practices have surfaced, indicating potential pitfalls.

Loan Requirements

- Age: Applicants should be at least 20 years old.

- Documentation: Mandatory submission of government-issued ID cards like Aadhar Card and PAN Card.

- Employment: A satisfactory salary is necessary for repaying the loan, and applicants need to provide 6 months to 1-year bank statements.

Dutta Rupee Loan App Review: Pros and Cons

Pros

- Straightforward Application Process: The app offers a user-friendly and time-efficient loan application process.

- Flexible Repayment Options: Borrowers can opt for lumpsum or monthly repayments.

- No Collateral Required: Dutta Rupee doesn’t demand collateral upon application.

- User-Friendliness: The application ensures a seamless and user-friendly experience for its users.

- Quick Loan Approval: The approval process is swift.

- Paperless Loan Process: Minimal documentation is required.

- Competitive Interest Rates: Dutta Rupee offers a competitive interest rate.

Cons

- Lack of Regulatory Approval: The app is not registered with the NBFC or the RBI.

- Questionable Practices: Complaints about unfavorable repayment practices have been reported.

- Negative User Reviews: Numerous users have shared bad experiences.

- Not on Google Play Store: Legitimate apps are typically found on official platforms.

- Limited Cancellation Process: The app lacks flexibility in canceling loans.

- Limited Repayment Methods: Borrowers face limited options for repayment.

- Allegations of Data Piracy: Unauthorized access to user data has been alleged.

- Inadequate Customer Support: Users report a lack of reliable support channels.

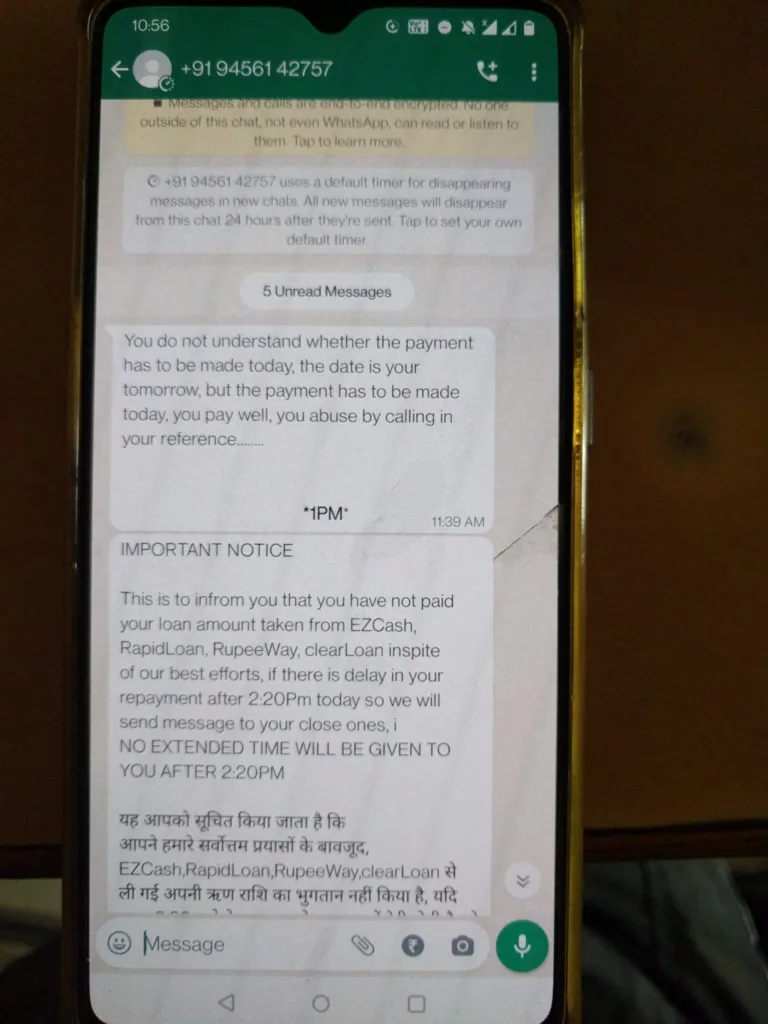

- Harassment and Blackmail: Troubling complaints about harassment and blackmail from users.

Dutta Rupee Loan App Real or Fake? Unveiling the Truth

Investigating the Legitimacy

After thorough research, it’s apparent that Dutta Rupee Loan App Review raises red flags. The app is conspicuously absent on Playstore, lacks a social media presence, and crucial details such as RBI approval, NBFC information, and the founder’s name remain elusive. This collectively paints a grim picture of its authenticity.

Dutta Rupee Loan App Review: User Complaints

In our comprehensive Dutta Rupee Loan App Review, delving into the question, “Dutta Rupee Loan App Real or Fake” we uncover 15 authentic user complaints that bring to light a concerning pattern of harassment, blackmail, and privacy invasion. From manipulated pictures to incessant calls and threats, these user experiences vividly illustrate the potential risks to personal security associated with Dutta Rupee.

Privacy Invasion and Harassment:

Users reported instances where the Dutta Rupee app allegedly sent morphed nude pictures to contacts and relatives, causing emotional distress and harassment.

Persistent Demands Despite Loan Repayment:

Several users claimed to have repaid their loans but continued to receive calls and messages demanding money. This raises concerns about the app’s questionable payment collection practices.

Unreasonable Demands and Abusive Language:

Instances were highlighted where borrowers faced excessive demands even after substantial repayments, accompanied by abusive language. This behavior adds a layer of intimidation and coercion.

Blackmail and Threats with Personal Information:

Users detailed experiences of receiving threats, including blackmail involving personal information like Aadhar and Pan cards. The alleged threats of sending explicit images to contacts intensify the severity of the situation.

International Harassment and Unwanted Messages:

Users mentioned receiving threatening calls and messages from foreign numbers, suggesting a sophisticated and widespread harassment network. This international element raises concerns about the app’s reach and potential involvement in illicit activities beyond national borders.

In summary, these user complaints collectively depict a disturbing pattern of unethical practices, invasion of privacy, and harassment by Dutta Loan App. The severity and consistency of these experiences highlight the potential risks associated with engaging with this platform, urging users to exercise caution and consider alternative financial solutions.

Also Read: Swift Seconds Loan App Review

Dutta Rupee Loan customer care helpline number

Contact Dutta Rupee Loan customer care at : 9547163385 and 8249254190

Conclusion: A Cautionary Tale

In conclusion, the Dutta Rupee Loan App Review strongly suggests that this platform is more scam than solution. Negative user experiences, combined with serious allegations, should deter anyone from considering Dutta Rupee for their financial needs.

Your financial safety is of utmost importance, and trusting an unverified platform like Dutta Rupee poses significant risks. The question of “Dutta Rupee Loan App Real or Fake” lingers, highlighting the need for caution.

Share your experiences and insights in the comments to protect others from potential harm. Remember, financial transactions demand trust, and Dutta Loan seems to fall short in this crucial aspect. Stay informed, stay safe.

1 Comment

I would like to express my admiration for your article, which is quite astonishing. The clarity of your post is remarkable, leading me to believe that you are an authority on this subject. If it’s okay with you, I would like to subscribe to your RSS feed in order to be notified of future posts. Your work is greatly appreciated.