Karta Loan App Scam: In the digital age, convenience often comes at the cost of vigilance. Today, we tell you about the scary things that happened to people who used the Karta Loan App. As we unravel the unsettling stories shared by individuals who fell victim to this alleged scam, it becomes crucial for everyone to be aware and cautious when navigating the world of digital lending.

The legitimacy of the Karta Loan App is uncertain, and user testimonials paint a concerning picture, raising questions about whether the Karta Loan App is real or fake. The promises of quick loans and easy transactions lure many into the world of digital lending. However, amidst the convenience, users of the Karta Loan App have shared distressing stories, revealing a darker side to this seemingly user-friendly platform.

Table of Contents

The Dark Side of Karta Loan App

Beware of Unauthorized Transactions

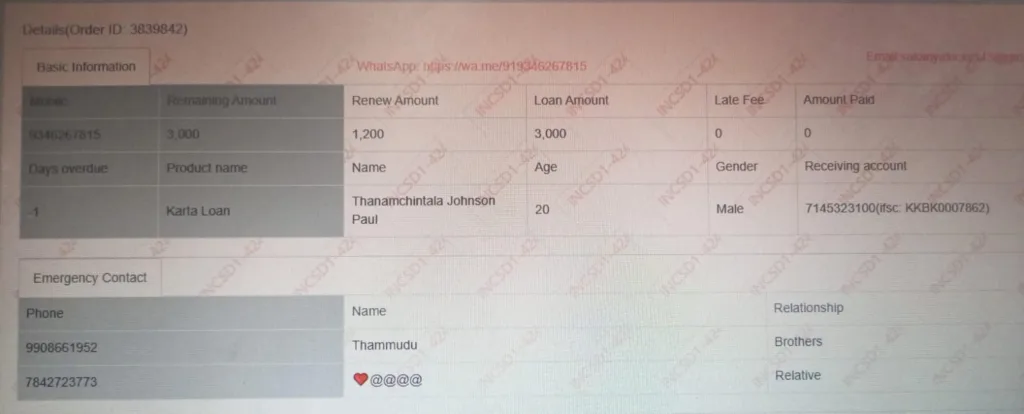

Reports flood in from users who claim to have never applied for loans but find mysterious transactions in their bank accounts. These unsolicited funds are often followed by relentless calls demanding repayment, creating a nightmarish scenario for unsuspecting individuals.

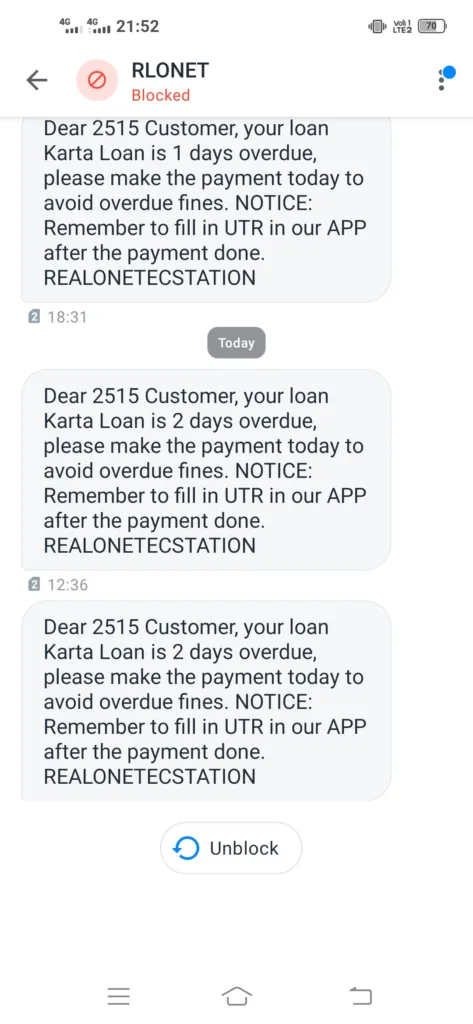

The unsuspecting users not only face financial strain but also find themselves entangled in a web of harassment. Messages demanding repayment, often coupled with explicit threats, paint a distressing picture of the tactics employed by those behind the alleged Karta Loan App scam.

Harassment and Threats

Imagine receiving explicit messages and threats after unknowingly receiving funds in your account. The stories shared by users detail a disturbing pattern of harassment, leaving them emotionally and mentally distressed. It’s crucial to recognize the signs and protect yourself from such malicious tactics.

Invasion of Privacy

The invasion of privacy associated with the Karta Loan App Scam extends beyond monetary concerns. Users recount receiving calls from unknown numbers and WhatsApp messages featuring manipulated explicit content. This invasion is not only distressing but also a grave violation of personal boundaries, making it essential for users to safeguard their personal information against the Karta Loan App Scam.

Protecting Yourself Against the Karta Loan App Scam

Stay Informed

Knowledge is your best defense. Stay informed about the experiences shared by others, and remain cautious when dealing with digital lending platforms. Understanding potential scams is the initial key to keeping yourself safe.

Verify Transactions

Regularly check your bank statements for any unauthorized transactions. If something odd occurs with your bank account, act quickly. Contact your bank immediately to address the issue. By reaching out to them and reporting the incident, you can help prevent further issues and protect your finances. Timely action can prevent further financial harm and help in resolving issues swiftly.

Guard Your Personal Information

Be cautious about sharing personal information, especially when dealing with unfamiliar financial platforms. Legitimate lenders will never engage in unsolicited transactions or demand repayment without proper communication.

Report Suspicious Activity

If you encounter any suspicious activity related to the Karta Loan App or similar platforms, report it to the relevant authorities. Your proactive approach can contribute to the prevention of scams and protect others from falling victim.

Also Read: Flash Loan App Review

Seek Legal Advice

If you’re facing harassment and threats, think about talking to a legal expert for guidance. Professionals can guide you on the best course of action to protect your rights and seek recourse, providing a potential avenue for resolution.

Conclusion

The stories shared by users paint a distressing picture of the alleged scam surrounding the Karta Loan App Scam. Everyone should stay alert, informed, and take action to shield themselves from possible financial risks. By staying aware and taking appropriate measures, we can collectively contribute to dismantling such scams and create a safer digital financial landscape for all.

How can I file a case against Karta Loan Fraud?

If you want to file a complaint against Karta Loan Fraud, go to the nearby police station or Cyber Crime Police Station. Make sure to bring a written complaint along with all the documents and information related to your case.

How can I put a stop to the harassment from Karta Loan Fraud?

If you’re facing harassment from loan recovery agents, you have options. According to the Indian Penal Code, 1860, specifically Section 506 dealing with Criminal Intimidation, you can make a complaint at the police station against the recovery agent and the recovery office.

Will the bank refund me for Karta Loan fraud?

Yes, in most cases, banks should refund you if you’ve sent money to someone due to a scam, commonly referred to as an ‘authorised push payment’ scam. If you paid through Direct Debit, you can often get a full refund as per the Direct Debit Guarantee.

5 Comments

Your comment is awaiting moderation.

I think that is among the so much significant information for me. And i’m happy studying your article. However should remark on few normal things, The web site style is wonderful, the articles is truly nice : D. Excellent task, cheers

[…] Karta Loan App Scam […]

The Karta Loan App has been associated with reports of unauthorized transactions, harassment, threats, and invasion of privacy, raising concerns about its legitimacy. To protect yourself from the Karta Loan App scam:

Stay informed about potential scams and exercise caution when dealing with digital lending platforms.

Regularly verify your bank statements for unauthorized transactions and report any irregularities to your bank promptly.

Guard your personal information and only share it with trusted and legitimate lenders.

Report any suspicious activity related to the Karta Loan App or similar platforms to relevant authorities.

Seek legal advice if you experience harassment or threats, as legal professionals can guide you on the best course of action to protect your rights and seek resolution.

By staying vigilant and taking appropriate actions, you can help prevent financial risks and contribute to a safer digital financial landscape.

[…] Also Read: Karta App Loan Scam […]

[…] Also Read: Karta Loan App Review […]

[…] Also Read: Karta Loan Scam Review […]