Credit Park Loan App Review: Greetings, readers! If you’ve stumbled upon this page, chances are you’re curious about the Credit Park Loan App and whether it’s a legitimate financial solution or a potential scam. Let’s dive into the details, explore the app’s features, and address some essential questions surrounding its authenticity.

Table of Contents

Decoding Credit Park Loan App: A Platform, Not a Lender

Credit Park Loan App operates as an online loan marketplace, acting as a facilitator for registered non-bank financial companies (NBFCs) or banks to extend loans to users. Interestingly, they keep their NBFC partners under wraps but proudly disclose their association with Vigelle Financial Services Limited.

Understanding the Credit Park Loan App

App Name: Credit Park

Simply put, if you borrow Rs 20,000, you have 120 days to pay it back:

- Daily Interest Rate: 18.25%/365 = 0.05%

- Interest per Day: Rs 10

- Interest per Month: Rs 300

- Monthly Payment: Rs 5,300

- Total Interest Fee: Rs 1,200

- Total Repayment: Rs 21,200

Keep in mind, there might be extra charges if you choose to use additional services.

Credit Park Loan Interest Calculation

Interest = Principal * Repayment Period (Days) / 365 * APR Total Repayment = Principal + Interest

For example, a 12-month loan of Rs 90,000 at a 27.6% yearly interest rate results in a total repayment of Rs 117,840, including processing fees and GST.

Application Conditions: Who Can Apply?

To access Credit Park Loan App services, users must meet certain criteria:

- Indian Resident

- Above 21 Years of Age

- Monthly Source of Income

If you tick all these boxes, you’re eligible to apply for a loan through Credit Park.

Security and Privacy: Your Information is Sacred

Credit Park assures users that their personal information is safe and won’t be shared without consent. The app follows a strict data safety protocol, collecting information such as location, personal details, financial information, messages, photos & videos, file & docs, contacts app, device IDs, app activity, and app info and performance.

Navigating the Complaints on Credit Park Loan App Terrain

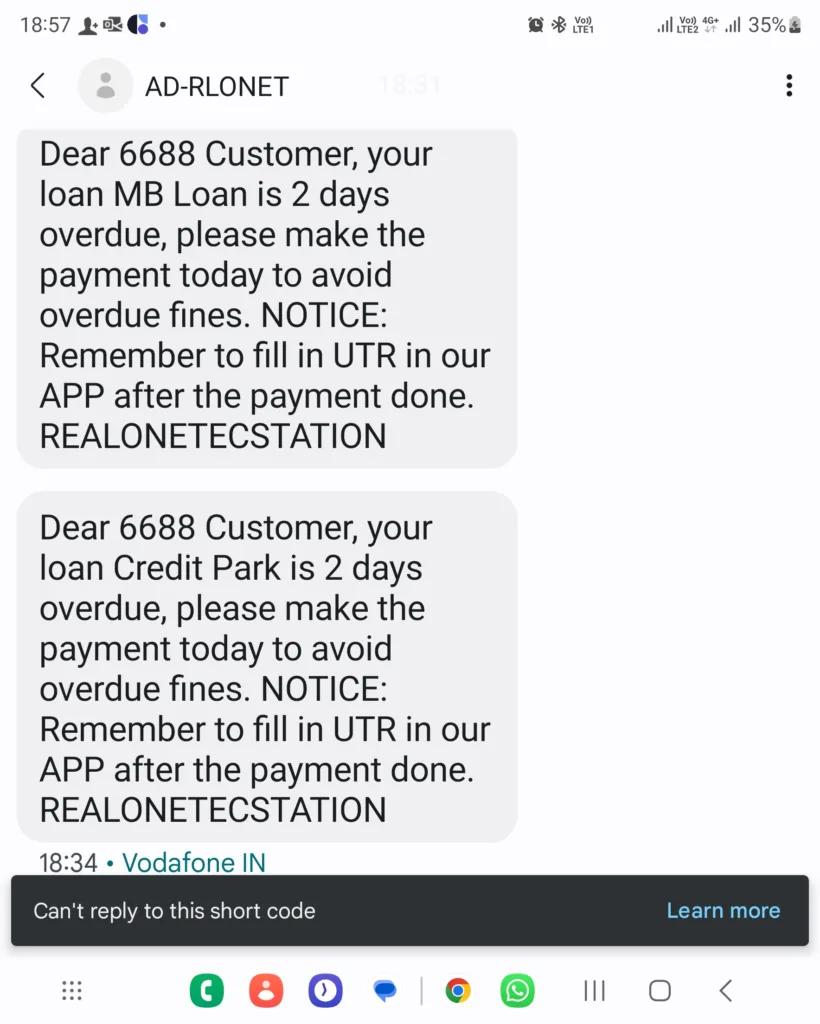

The internet echoes with Credit Park Complaints, with users sharing their tales of woe on consumer complaints websites. It’s crucial to consider these firsthand experiences before venturing into the Credit Park territory.

- Credit Park people keep calling and messaging me on WhatsApp, insisting I owe them Rs 3,500 for a loan I never even took. They’re making threats and saying they’ll do something unwanted if I don’t pay.

- I checked out some loan apps, and out of the blue, I got Rs 2,100 twice in my account without applying. Now, they want me to pay Rs 3,500 each within five days, or they’ll share my selfie and PAN card copy with everyone I know. I blocked their numbers.

- Now, I’m getting messages from these loan apps, saying I haven’t paid the amount and threatening me to pay up.

Steps to Financial Assistance

Curious to try Credit Park Loan App? Here’s a step-by-step guide:

- Install Credit Park Loan App

- Sign-Up with Your Mobile Number

- Fill in Basic Information and Check Your Eligibility

- Upload KYC Documents: ID, Address Proof, and PAN Card

- Request a Bank Transfer or E-Voucher for Your Loan

Conclusion

In conclusion, Credit Park Loan App appears to be a platform connecting users with loan providers. However, the abundance of complaints signals caution. Before you decide, think about the good and bad stuff, see what others say, and check out different ways to handle your money. Stay informed, stay secure.

Is Credit Park Loan App Scam?

We’re not sure if the Credit Park Loan App is a scam, but the way they operate doesn’t seem right. We saw some things on the app that could be warning signs, and we just want everyone to know about them.

Is Credit Park App Real or Fake?

The Credit Park App is indeed a real app that offers loans to people. However, there have been complaints. Some members receive money even without applying, and some don’t get the loan but are still asked to repay it.

6 Comments

Your comment is awaiting moderation.

providing a unique and comforting companionship experience.ラブドール 中古I highly recommend Dream Dolls for their outstanding realism and quality.

Your comment is awaiting moderation.

000 people who have sex once a week,only two or three will experience another heart attack,セックス ドール

Your comment is awaiting moderation.

人形 エロfollowing Marilyn’s miscarriage,”Have you a complex about losing babies? You lost two unborn children,

Your comment is awaiting moderation.

【マンガ】「全員めちゃくちゃにしてやる!」セックス ロボット愛する男に肝臓を奪われた女の叫び〈肝臓を奪われた妻〉

Your comment is awaiting moderation.

This post was really useful! If bad credit has been stopping you from getting a loan, this Telegram channel might be the solution: https://t.me/iBorrow_bot.

Your comment is awaiting moderation.

For a bonus treat at check-in,book the Gingerbread Holiday Package and make an early reservation for dining in the decked-out on-site restaurants.t バック

Your comment is awaiting moderation.

distances,and safety tips,人形 エロ

Your comment is awaiting moderation.

what else are they going to do? Sure,リアル ドールall these areas play some part in our development,

Your comment is awaiting moderation.

As a singer and performer, this virtual reality personality 人形 エロis changing the world of sex dolls in a big way.

Your comment is awaiting moderation.

travel is an adventure,エロ 下着a way to discover all that the world has to offer.

Your comment is awaiting moderation.

While many relationships may display one or two of these,toxic relationships will often feature multiple alarm bells.エロ 人形

Your comment is awaiting moderation.

which will reopen in May 2023 after a year-long closure with 10 new oceanfront suites and Latin America’s first Guerlain spa.セクシー下着Farther south,

Your comment is awaiting moderation.

as Landeen already mentioned,中国 エロcould be hormonal.

Your comment is awaiting moderation.

they make for fascinating reading.リアル エロIn the dream collections of anthropologist Dorothy Eggan,

Your comment is awaiting moderation.

not having as high a sex drive as they are expected to ‘or they’ve watched porn and compare their penises’.ラブドール 女性 用 In a GQ survey, 54 of men said that watching porn made them feel self-conscious.

Your comment is awaiting moderation.

or maybe it’s more like a buzz,and I slump further under the blanket covering my legs.ラブドール 中出し

Your comment is awaiting moderation.

But you stay in it and swim past the breakers.And things get better.ラブドール 女性 用

Your comment is awaiting moderation.

beluga99

Magnificent website. Plenty of helpful info here.

I am sending it to several buddies ans additionally sharing

in delicious. And certainly, thanks on your effort!

Your comment is awaiting moderation.

Our e-newsletter hand-provides the most effective bits for your inbox. 初音 ミク ラブドールSign up to unlock our electronic Publications as well as acquire the newest news, situations, delivers and companion promotions.

Your comment is awaiting moderation.

I encourage asking them what about it grosses them out,jydoll Frye-Nekrasova advises. “A lot of the apprehension people have is because they don’t fully understand the period, so offering some additional knowledge can help.

Your comment is awaiting moderation.

or involve others in ways that are not consensual.That is,オナホ

Your comment is awaiting moderation.

Sexuality isn’t just about sex.It’s also about how your child:feels about their developing bodymakes healthy decisions and choices about their own bodyunderstands and expresses feelings of intimacy,オナホ おすすめ

Your comment is awaiting moderation.

ラブドール 高級chutneys and vinegars in place of sour cream,butter and creamy sauces.

Your comment is awaiting moderation.

また、その逆に、性的欲求を満たすことのできるコンパニオンロボットを、オナドール孤独の解消や快楽の提供、あるいは強制性をともなうセックスワークの根絶や、

Your comment is awaiting moderation.

consistently arrives late to meetings and submits work post team deadlines.Chloe,リアル ドール

Your comment is awaiting moderation.

sex dolls can be a comforting presence without the worry irontech dollof being turned down or facing emotional challenges.

Your comment is awaiting moderation.

Chinese sexual intercourse doll makers’ export orders doubled this calendar year throughout初音 ミク ラブドール the COVID-19 pandemic as a result of loneliness introduced about by rigorous social distancing steps, media experiences said.

Your comment is awaiting moderation.

it will be difficult to trust them,ロボット セックスwhich can cause a strain in the relationship over time.

Your comment is awaiting moderation.

ラブドールHe was to find out later that he had suffered from a heart attack.A call to a physician would have been useful.

Thanks Bhai for this review

[…] Seconds identifies itself as an online loan application, specializing in providing users with expedited access to personal loans while asserting to offer a […]

[…] Also Read: AA Kredit Loan App Review, Flash Loan App Review, Credit Park Loan App Review […]

[…] conclusion, Realonetecstation Loan Review has encountered a myriad of user complaints, totaling 12 distinct issues. Ranging from misleading […]

[…] Also read: Credit Park Loan App Review: Real or Fake? […]

Curious about the Credit Park Loan App? 📱 It operates as an online loan marketplace, facilitating loans from registered non-bank financial companies. They emphasize their association with Vigelle Financial Services Limited. To borrow Rs 20,000, you’d repay Rs 21,200 in 120 days, with a daily interest rate of 0.05%. Eligibility includes being an Indian resident, over 21, and having a monthly income. They promise data security but beware of complaints from users who’ve had negative experiences. Before diving in, consider the pros and cons, read reviews, and explore your financial options. Stay informed and secure. 🤔💸 #CreditParkLoanApp #FinancialReview