Living in today’s digital era means financial solutions are just a click away, but it also brings the rise of fake loan apps, a significant threat to unsuspecting borrowers. With the government working to stop scams, it’s really important for everyone to know about them and take action to stay safe. Being aware and smart can help you recognize and avoid scams, keeping you protected We need to be smart and active in learning about these scams so we can stay safe.

This blog aims to guide you thoroughly on safeguarding against fraudulent loan apps, ensuring a secure financial journey in our digital age.

Table of Contents

Immediate Financial Needs and Loan App Temptations

In times of immediate financial need, the temptation of instant personal loans through mobile loan apps can be strong. However, it’s essential to approach this convenience with caution, as the digital lending space is not immune to scams and frauds. This guide aims to shed light on the potential risks associated with instant fake loan apps and provides valuable insights on how to protect yourself. Opting for reputed platforms is a crucial step that can significantly enhance your safety when seeking an instant personal loan.

Choosing Reputed Platforms for Safety

While the allure of quick loans is understandable, the potential risks of scams and frauds highlight the need for careful consideration. This guide emphasizes the importance of choosing reputed platforms. In our ever-evolving digital landscape, making informed choices and staying vigilant serve as powerful shields against potential scams, ensuring a secure and hassle-free borrowing experience.

How the Government is Stopping Fake Loan Apps

The government’s commitment to tackling fake loan apps is evident through various measures aimed at protecting consumers. One key recommendation is to download apps exclusively from trusted banks and Non-Banking Financial Companies (NBFCs), instilling confidence in users that they are engaging with legitimate financial entities.

Rise in Fraud Cases

The surge in digital loans, prompted by job losses, financial downturns, and rising medical expenses, has unfortunately given rise to fraudulent activities. RBI, which is like the money boss of India, saw a big problem and decided to do something about it. They made some rules to make things better.

They made rules, called guidelines, to control and manage digital lending platforms. They have given out rules to control digital lending platforms. These guidelines emphasize the need for a transparent and secure lending environment.

Understanding Instant Loan Scams and Frauds

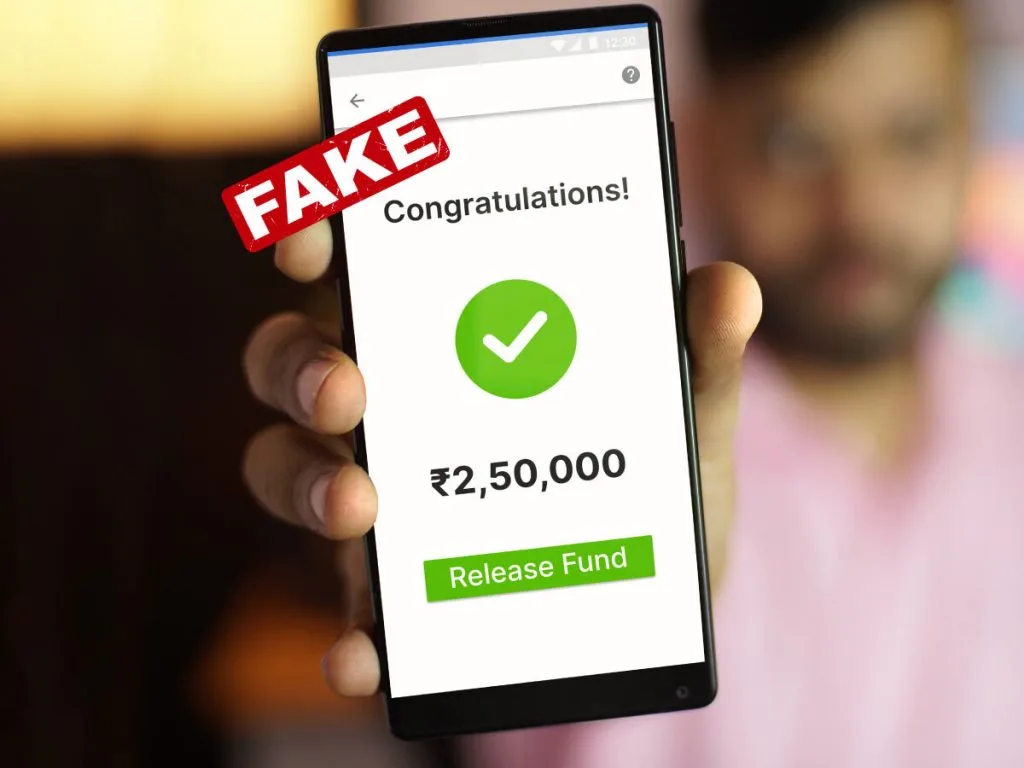

The digital era has seen a rise in scams and frauds related to fake loan apps, taking advantage of people urgently seeking quick funds. Scammers leverage the ease of digital lending platforms and mobile apps, promising swift approvals and attractive interest rates to lure unsuspecting borrowers.

However, behind these seemingly convenient offers lie malicious intentions, ranging from stealing personal information to extorting money and even committing identity theft. While digitalization has undeniably enhanced transactional convenience, it has also paved the way for the unfortunate rise of fake loan apps frauds and scams.

The Urgency Trap

Scammers often prey on the urgency of individuals requiring immediate financial assistance. Their tactics involve offering quick approvals and seemingly attractive interest rates, creating a sense of urgency that prompts borrowers to overlook critical details. As a borrower, it’s essential to resist the pressure and thoroughly evaluate the legitimacy of the loan offer.

Personal Information Vulnerability

One of the primary goals of instant fake loan apps scams is to harvest personal information from unsuspecting borrowers. This information may include sensitive details like contact numbers, addresses, and financial data. To protect yourself, always be cautious about the information you share and ensure that the lending platform is trustworthy and secure.

Extortion and Illegitimate Practices

Scammers may resort to extortion tactics, demanding upfront fees or charges under the guise of loan approval. Legitimate lending platforms typically deduct any fees post-approval, ensuring transparency. Be skeptical of apps seeking money before granting approval, as this is a red flag for potential fraudulent practices.

Identity Theft Concerns

The malicious intent behind instant fake loan apps scams extends to identity theft. Scammers might take your personal info and pretend to be you, causing big problems with money and your personal life. Choosing a reputable platform with stringent security measures minimizes the risk of falling victim to such heinous crimes.

How to Identify Fake Loan Apps

- Online Phishing: In addition to checking for a secure ‘https’ connection, scrutinize the website for a padlock symbol in the address bar. Legitimate websites use this symbol to indicate a secure connection. If absent, it’s a red flag signaling potential phishing.

- Loan Fees or Charges: While upfront processing fees are common, be cautious if a loan app insists on payment before approval. Legitimate lenders deduct processing fees from the loan amount post-approval, ensuring transparency. Any deviation from this norm should raise suspicions.

- Avoid Lucrative Offers: Beyond tempting offers, evaluate the interest rates offered. Unrealistically low rates may indicate a scam. Genuine lenders provide competitive but realistic rates, and any offer that seems too good to be true should be treated with skepticism.

- Scrutinize Terms and Conditions: Delve into the terms and conditions provided by the loan app. Genuine lenders maintain a standard and transparent set of terms. If the terms appear convoluted or overly favorable, it’s advisable to seek clarification or, better yet, explore alternative lending options.

- App Permissions: Review the permissions requested by the loan app. Legitimate apps only ask for necessary permissions, typically related to the loan application process. Be wary if an app seeks unnecessary access to personal data, as this may indicate malicious intent.

- User Reviews and Ratings: Before downloading any loan app, check user reviews and ratings on trusted app stores. If you check out what peoples are saying about the app, you can kinda tell if it’s good or not. People’s opinions give you a hint if the app is worth a shot or not. Others’ experiences and opinions provide valuable insights. Others’ opinions help you decide if the app is worth using. If they share real experiences, it gives you a clue about whether the app is trustworthy and if people like using it.

- Customer Service Quality: Legitimate loan providers prioritize customer service. Verify the availability and responsiveness of customer support before engaging with any loan app. A lack of proper customer service channels may indicate a fraudulent operation.

- Physical Office Presence: Established financial institutions often have physical offices. If possible, verify whether the lending entity has a physical presence. A lack of a verifiable office address can be a warning sign of a potential scam.

- Cross-Verification of Details: Cross-verify the details provided by the loan app. Check the official website of the lending institution or contact them directly to confirm the app’s authenticity. Scammers often create convincing replicas, making cross-verification crucial.

- Legal Compliance: Legitimate loan apps adhere to legal regulations and display necessary licenses. Verify the app’s compliance with financial regulations and licenses issued by relevant authorities before proceeding with any financial transactions.

Conclusion

As the financial landscape continues to evolve, so do the tactics of scammers. Protecting oneself from fake loan apps requires a multi-faceted approach, combining government initiatives, individual awareness, and additional precautionary measures. By incorporating the suggested points and staying informed, borrowers can significantly reduce the risk of falling victim to scams. Remember, a secure financial journey begins with informed choices, and together, we can create a safer digital lending environment for all.

How to protect ourselves from fake loan apps?

To stay safe from fake loan apps, look for real ones that keep your info safe. Legit instant loan apps usually use good security stuff, like SSL certificates and the latest encryption. You can find this info in the app details or by searching online.

How do I stop fake loan apps from accessing my phone?

Stopping fake loan apps from poking around your phone is easy. If you’re using your Android or iPhone, just go to Settings and look for something called Apps Manager. Click on Apps Permission, and there you can pick the loan app you want to control. That’s all!

2 Comments

[…] checked out some loan apps, and out of the blue, I got Rs 2,100 twice in my account without applying. Now, they want me to pay […]

It’s essential to stay vigilant when dealing with loan apps in today’s digital age. 📱 Scammers are getting more creative, and their tactics can be convincing. 💰 Choosing reputable platforms, checking for red flags like upfront fees, and scrutinizing terms and conditions are all crucial steps to protect yourself. 🔒 User reviews, customer service quality, and cross-verification of details can also provide valuable insights. 💡 Let’s all work together to create a safer digital lending environment! 👍 #StaySafe #FinancialSecurity 💳🔐